DenizBank’s subsidiary fastPay, Turkey’s first digital wallet, and Asis Elektronik, which transforms contactless cards used in public transportation into EMV-based open platform city cards Prepaid City Card and Mobile Wallet App is coming to life.

Thanks to the Prepaid City Card and Mobile Wallet Application, which will carry the features of public transportation cards such as discounts and transfers, all services for the city will be provided from a single point.

With the project to be realized by fastPay Elektronik Para ve Ödeme Hizmetleri A.Ş., a subsidiary of DenizBank, and Asis Elektronik, it is aimed to realize the City Services Platform that will enable tradesmen and merchants, especially local administrations, to interact more closely with the city dwellers and mediate the payment of social aids and all local services.c

Users will be able to make transactions at all domestic and international merchants and ATMs with the Prepaid City Card, and meet their financial needs such as shopping/money withdrawal, money transfer and corporate payments with the Mobile Wallet Application. In addition, they will be able to easily apply for many financial products from within the application.

“We are happy to develop financial technology solutions that will contribute to the ecosystem”

DenizBank Retail Banking Group Executive Vice President and fastPay A.Ş. Chairman Ayşenur Hıçkıran,

“fastPay, the first mobile wallet launched by a bank in 2012, continues its activities today under the roof of fastPay A.Ş., an electronic money and payment institution licensed by the Central Bank of the Republic of Turkey. We are extremely happy to be a part of this cooperation that facilitates access to financial technologies in all services for urban life, especially transportation, with the contributions of NEOHUB, DenizBank’s new generation subsidiary established with the aim of producing innovative business models with a culture of cooperation and implementing financial technology solutions that will contribute to the ecosystem.”

“We will make it easier for urbanites to access financial services”

Serkan Turan, General Manager and Board Member of fastPay A.Ş., that he

“Since day one, we have implemented our service model with a vision that aims to provide you with access to financial products and services even if you are not a customer of any bank. We are happy to share our know-how, license and infrastructure with the institutions with which we cooperate with the Service Model Wallet model and with which we will grow the ecosystem together. With our cooperation with Asis Elektronik, we will also facilitate access to DenizBank products and services as an interface provider. In this way, we aim to realize the world’s most comprehensive city card and mobile wallet application in the cities served by Asis Elektronik.”

“We offer integrated solutions to the transportation sector”

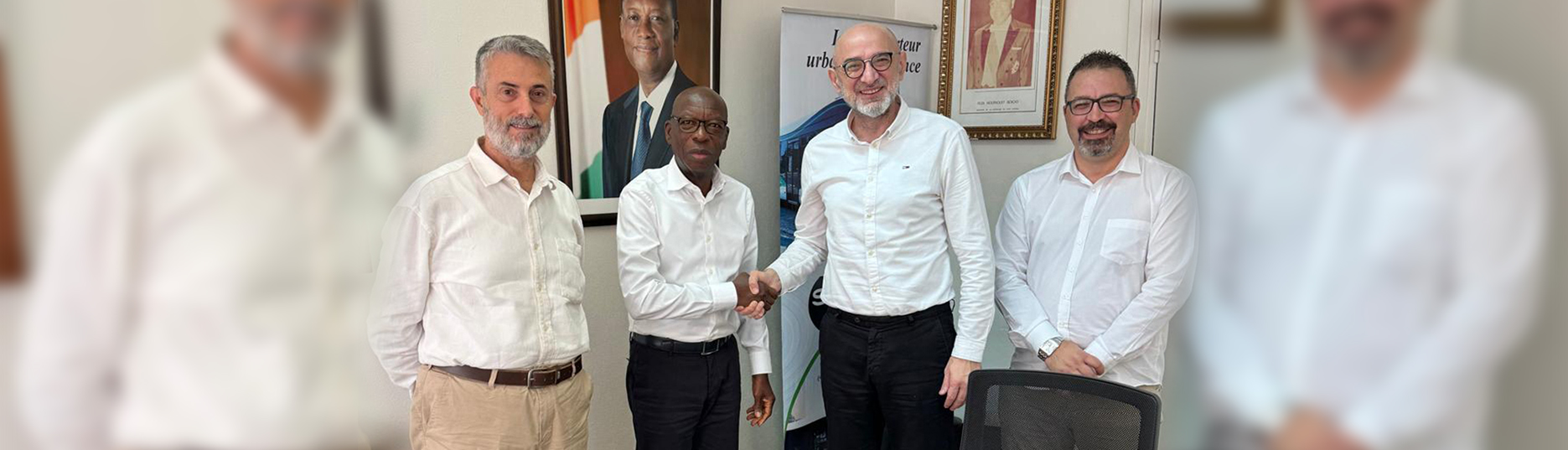

Hakan Özyürek, General Manager and Board Member of Asis Elektronik, stated that they offer integrated solutions to the transportation sector together with their stakeholders with the technologies they have developed for electronic toll collection systems and smart cities and added: “We are excited to launch a city card and mobile wallet application for our citizens who use our public transportation cards with our cooperation with DenizBank and fastPay A.Ş., which they can use in Turkey and abroad in addition to all the advantages of public transportation.”

Asis Elektronik Board Member Levent Uğurlu,

“In this period when Embedded Finance applications that enable non-financial service providers such as Asis Elektronik to offer financial products to their customers are rapidly becoming widespread in the fintech ecosystem, we will offer the Service Model Wallet and Multifunctional City Card project to our users with DenizBank and fastPay infrastructure, starting with the cities we serve. Thus, we will have taken a very important step in our vision of transforming Asis Elektronik into a financial technology company. We also aim to carry the productive cooperation we have started to different platforms within the framework of Service Model Banking.”